Wages calculator wa

Employers wont pay any share of premiums for their employees. Employment and Wages Data Viewer.

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

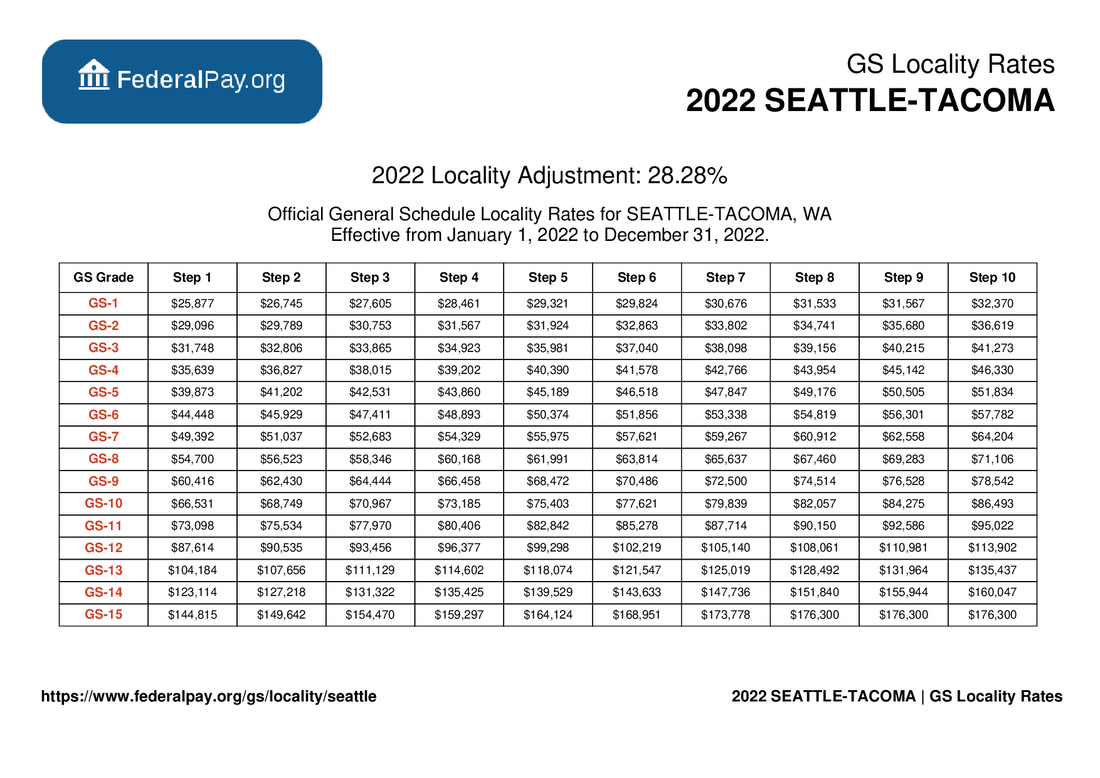

2021 Locality Pay Area Definitions.

. Claim Decisions Toggle submenu. Additional information including the hourly and annual 10th 25th 75th and 90th percentile wages and the employment percent relative standard error is available in the downloadable XLS file. European countries by monthly median wage.

Back Pay Calculator Toggle submenu. 2019 General Schedule Base Complete set of Locality Pay Tables. The calculator will then total the amounts and provide you an estimate.

We exclude wages of top-coded individuals because top-coded earnings will show up as having zero wage growth which is unlikely to be accurate. Salaries Wages Toggle submenu. Links to OEWS estimates for other areas and states.

The WA Cares premium is paid by the employee. Service industry wages 1920-1933 Shows the average weekly wages of union hotel and restaurant employees. For amount to withhold see tax tables in IRS Publication 15 Employers Tax Guide.

Were on call whenever you need us. Economy at a Glance. Paid time off PTO reduces your weekly benefit amount.

More Information Including Links to ONET. Gross wages are pre-tax wages minus tips. A tapering value formula is used to calculate the gradual reduction in the deductable amount which employers may claim against their WA taxable wages between the annual threshold amount of 1000000 and the upper threshold amount of.

Half the employees in a country earn above the median and the other half below. Shows monthly wages based on the ocean routes traveled. On October 15 2020 final regulations to define General Schedule GS locality pay areas were published on behalf of the Presidents Pay Agent in the Federal Register.

The median is more representative of what a random chosen employee might earn than the mean value which may be skewed. You can call us Dr. Where competition for finding and hiring staff is the fiercest could see.

Calculation for the diminishing threshold. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. The final regulations which are applicable the first day of the first pay period in January 2021 establish a new Des Moines-Ames-West Des Moines IA locality pay area and.

2020 General Schedule Base Complete set of Locality Pay Tables. Click on one of the links below and you will be transferred to the calculator where you can enter you name date and various income information. If you are using a voluntary plan for family or medical leave your calculations may be different.

Recruitment Relocation. Links to OEWS estimates for other areas and states. Send amounts withheld to the IRS electronically using EFTPS.

Regions States Areas at a. SSI SSDI and In Depth Benefits Calculator Open the. CPI Inflation Calculator.

CPI Inflation Calculator. All employers are required to do one of the following. A single payroll tax liability is calculated based on the combination of rates.

BLS Monthly Labor Review Aug 1933. Pay Table Annual Rate Hourly Rate XML Data. These calculators will help in estimating the effects of income like work earnings on your SSI or SSDI.

Industry Finder from the Quarterly Census of Employment and Wages. While an apple wont be able to help you calculate payroll taxes we can. Compare the job duties education job growth and pay of dental hygienists with similar occupations.

323 2808 58400. Withholding amount is based on each employees total wages and the latest IRS Form W-4 the employee completed. Federal income taxes employee paid.

You will receive up to 90 percent of your weekly payup to the maximum weekly benefit amount which is updated yearly. Injury and Illness Calculator. More Information Including Links to ONET.

13-0000 Business and Financial Operations. The median wage is the amount that divides the population into two equal groups. In May 2021 the median annual wages for pharmacists in the top industries in which they worked were as follows.

The tool helps individuals communities and employers determine a local wage rate that allows residents to meet minimum standards of living. Employers withhold income taxes from employee paychecks. Additional information including the hourly and annual 10th 25th 75th and 90th percentile wages and the employment percent relative standard error is available in the downloadable XLS file.

OnPay the Washington and Federal payroll tax simplifiers. San Francisco to points west and New York City to points south and east. We developed a living wage calculator to estimate the cost of living in your community or region based on typical expenses.

We will determine your weekly benefit amount based on wages reported by your employers. Additional information including the hourly and annual 10th 25th 75th and 90th percentile wages is available in the downloadable XLS file. Compare the job duties education job growth and pay of financial managers with similar occupations.

A Excluding social and private benefits. The assumption is the sole provider is working full-time 2080 hours per year. Injury and Illness Calculator.

Living Wage Calculation for Seattle-Tacoma-Bellevue WA. State local and private. Industries with the highest published employment and wages for Social Workers All Other are provided.

Injury and Illness Calculator. The top-code is such that the product of usual hours times usual hourly wage does not exceed an annualized wage of 100000 before 2003 and 150000 in the years 2003 forward. Fair Labor Standards Act.

This occupation includes the 2018 SOC occupations 21-1011 Substance Abuse and Behavioral Disorder Counselors and 21. This calculator uses the 2019 cap at 132900. In the first quarter of the new year.

For WA Cares reporting. Occupational Employment and Wages May 2021 21-1018 Substance Abuse Behavioral Disorder and Mental Health Counselors. Explore resources for employment and wages by state and area for dental hygienists.

All you need to do is enter wage and W-4 information for each of your go-getting employees and our calculator will take care of the rest. The WA Cares premium rate is 058 percent of each employees gross wages there is no Social Security cap. Major Occupational Groups Note--clicking a link will scroll the page to the occupational group.

Explore resources for employment and wages by state and area for financial managers. Pay Table Annual Rate Hourly Rate XML Data. Shoe industry wages 1910-1930.

Washington Paycheck Calculator Smartasset

Washington Wage Calculator Minimum Wage Org

Seattle Pay Locality General Schedule Pay Areas

Esdwagov Calculate Your Benefit

Esdwagov Calculate Your Benefit

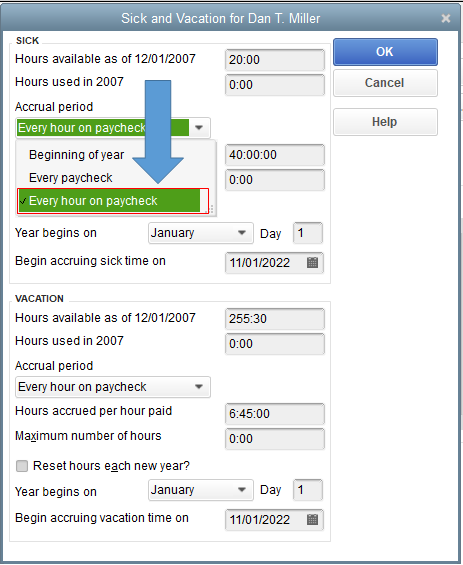

Solved How Do I Set Up Sick Leave Accurals For The New Wa State Sick Leave Law 1 Hour Earned For Every 40 Hours Worked

2

Equivalent Salary Calculator By City Neil Kakkar

Chart The Living Wage Gap Statista

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Free Paycheck Calculator Hourly Salary Usa Dremployee

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Calculating Holiday Pay Employees Paid In Advance

![]()

Free Washington Payroll Calculator 2022 Wa Tax Rates Onpay

Wage Calculation In L I Workers Compensation Claim Reck Law Pllc

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel